Roots Analysis has announced the addition of “The Human Microbiome Market, (4th Edition) 2022-2035” report to its list of offerings.

The microbiome-based therapies pipeline features six drugs in phase III clinical development, over 200 candidates in other clinical and preclinical stages of development along with more than 60 diagnostics and screening / profiling tests that are commercialized for the detection of various diseases. However, the current microbiome market is driven by the fecal microbiota therapies approved by the FDA, particularly for the recurrent CDI and the commercialized diagnostic tests available to the patients. The human microbiome remained a largely unexplored area until 2007 when the Human Microbiome Project (HMP) was initiated. Given the role of microbiota in disease development and pathogenesis, the concept of microbiome-based therapeutics has generated significant enthusiasm within the medical science community, thereby, defining a new frontier in the field of medicine.

Key Market Insights

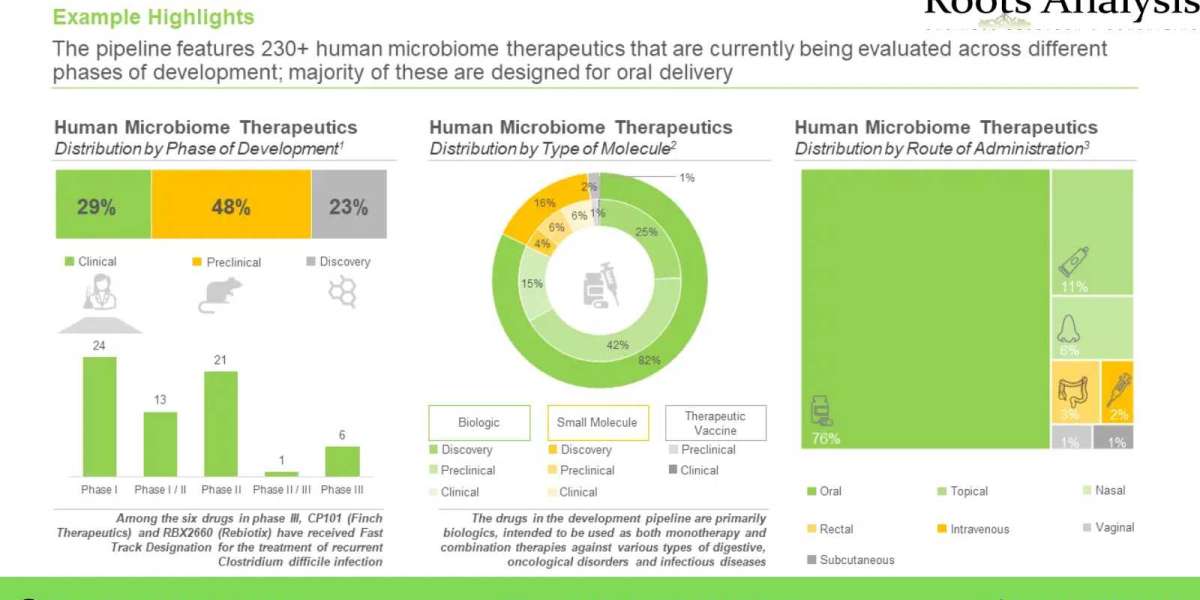

Over 230 drug candidates are currently being developed by more than 70 drug developers

Nearly 30% of the pipeline drugs are in clinical phase of development, while more than 150 drugs are in preclinical and discovery stages. Clinical stage drugs are primarily being developed for infectious diseases and digestive disorders, while candidates in preclinical and discovery stages are focused on oncological disorders.

More than 75 diagnostics and screening / profiling test are available / under development

Of these, around 80% of the tests are available in the market, while rest are under development. More than 40 companies are engaged in providing these tests; these are primarily based in North America (45%) and Europe (39%). It is worth highlighting that majority (68%) of the players are small companies.

FMTs are the only commercially available microbiome therapies approved by the FDA

These therapies are primarily used for the treatment of recurrent Clostridium difficile infection (rCDIs). It is worth mentioning that more than 400 trials have been registered for evaluating these therapies for a wide range of indications.

Partnership activity in this domain has increased at a CAGR of 26%, between 2017 and 2021

Maximum number of partnerships were established in 2021, indicating a recent rise in the interest of players engaged in this domain. It is worth highlighting that majority of the deals were RD agreements, representing over 35% of the total number of partnerships signed in the given time period.

More than USD 1 billion has been invested by both private and public investors, since 2017

Of the total amount invested, over USD 563 million was raised through venture capital financing, representing over 56% of the overall funding activity in this domain. Further, 36 instances of grants / awards were also reported, wherein players collectively raised more than USD 137 million.

Outsourcing has become an integral part of the microbiome and live biotherapeutics development process

Presently, over 25 service providers claim to offer a multitude of contract manufacturing services for microbiome and live biotherapeutic products. It is worth noting that close to 10 firms were established post 2010 and around 45% of the players are located in Europe.

Microbiome therapeutics are anticipated to capture more than 60% share of total microbiome market by 2035

As late-stage therapeutics will get approved by the FDA in the foreseen future, the microbiome therapeutics market is likely to grow at an annualized rate of 37% till 2035. It is worth mentioning that microbiome diagnostics is likely to capture 20% of the total microbiome market share by 2035.

To request a sample copy / brochure of this report, please visit

https://www.rootsanalysis.com/reports/281/request-sample.html

Key Questions Answered

- Who are the leading players engaged in the development of microbiome therapeutics?

- Which are the key microbiome based drugs being developed across various stages of development?

- Which companies are actively involved in conducting clinical trials for microbiome therapeutics and FMTs?

- Who are the leading players engaged in the development of microbiome diagnostics and screening / profiling tests?

- Which types of partnership models are commonly adopted by industry stakeholders?

- Who are the key investors in the field of human microbiome therapeutics and diagnostics?

- What are the different initiatives undertaken by big pharma players for the development of human microbiome therapeutics in the recent past?

- What is the role of various start-ups engaged in developing human microbiome therapeutics?

- Which are the most commonly targeted therapeutic indications for which microbiome therapeutics are being developed?

- What are the various steps involved in the manufacturing of microbiome therapeutics?

- What are the key considerations for selecting a CMO / CRO for manufacturing of microbiome therapeutics?

- What are the various algorithms / tools used to analyze data generated from microbiome research?

- How is the current and future opportunity, related to microbiome therapeutics, diagnostics and FMT likely to be distributed across key market segments?

- What are the various non-pharma applications of microbiome products?

The financial opportunity within the human microbiome therapeutics market has been analyzed across the following segments:

- Type of Product

- Probiotic Drugs

- Other Drugs

- Target Indication

- Recurrent C. difficile Infection

- Necrotizing Enterocolitis

- Primary Hyperoxaluria

- Graft versus Host Disease

- Therapeutic Area

- Infectious Diseases

- Digestive and GI Disorders

- Rare Disorders

- Route of Administration

- Oral Route

- Rectal Route

- Type of Formulation

- Capsules

- Suspensions

- Enemas

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

The financial opportunity within the human microbiome diagnostics and screening / profiling tests market has been analyzed across the following segments:

- Target Indication

- Irritable Bowel Syndrome

- Inflammatory Bowel Disease

- Colorectal Cancer

- Diabetes Mellitus

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

The financial opportunity within the fecal microbiota therapies market has been analyzed across the following segments:

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

The report features inputs from eminent industry stakeholder(s), who were very optimistic concerning the growth of the human microbiome market. It includes detailed transcripts of the discussions held with the senior representatives of the stakeholder firms, including:

- Charlie Badham (Senior Manager, Corporate Development, 4D Pharma)

- Nicholas Monsul (Co-founder and Chairman, Quorum Innovations)

- Alicia Scheffer (Chief Executive Officer, Floragraph)

- Aaron Wright (Senior Scientist, Pacific Northwest National Laboratories)

- Alexander Lin (Associate General Manager, Chung Mei Pharmaceutical)

- Alexander Segal (Vice President, Business Development, Universal Stabilization Technologies)

- Assaf Oron (Chief Business Officer, BiomX)

- Debbie Pinkston (Former Vice President, Sales and Business Development, List Biological Laboratories)

- Veronika Oudova (Co-founder and Chief Executive Officer, S-Biomedic)

- Colleen Cutcliffe (Co-founder and Chief Executive Officer, Pendulum Therapeutics)

- Nikole Kimes (Co-founder and Chief Executive Officer, Siolta Therapeutics)

- James Burges (Ex-Co-founder and Vice President of Innovation, OpenBiome)

- Gregory J Kuehn (Vice President, Business Development and Marketing, Metabiomics)

- JP Benya (Ex-Vice President, Operations, Assembly Biosciences)

- Lee Jones (President and Chief Executive Officer, Rebiotix)

- Mark Heiman (Ex-Chief Scientific Officer and Vice President, Research, MicroBiome Therapeutics)

- Pierre-Alain Bandinelli (Chief Strategy Officer, Da Volterra)

The report also includes detailed profiles of the companies (listed below) engaged in developing microbiome therapeutics, diagnostics and screening / profiling test; each profile features an overview of the company, its financial information (if available), details on its product portfolio, recent developments, and an informed future outlook.

- 4D Pharma

- Biosotia Microbiomics

- DNA Genotek

- Finch Therapeutics

- GoodGut

- Infant Bacterial Therapeutics

- Invivo Healthcare

- MaaT Pharma

- OxThera

- Qu Biologics

- Rebiotix

- Seres Therapeutics

- Servatus

- Shoreline Biome

For additional details, please visit https://www.rootsanalysis.com/reports/view_document/human-microbiome-market/281.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Targeted protein degradation market, 2022-2035

- Single-Use Upstream Bioprocessing Technology / Equipment Market, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091