Roots Analysis has announced the addition of “Biopharmaceutical Excipient Market” report to its list of offerings

Owing to the highly complex and capital-intensive manufacturing processes of biopharmaceutical excipients, many contemporary biologic developers prefer to rely on CMOs for the supply of GMP grade excipients. In order to cater to the growing demand for biopharmaceutical excipients across both clinical and commercial scales, CMOs with expertise in this field are anticipated to expand their capabilities and existing capacities in the coming years.

Key Market Insights

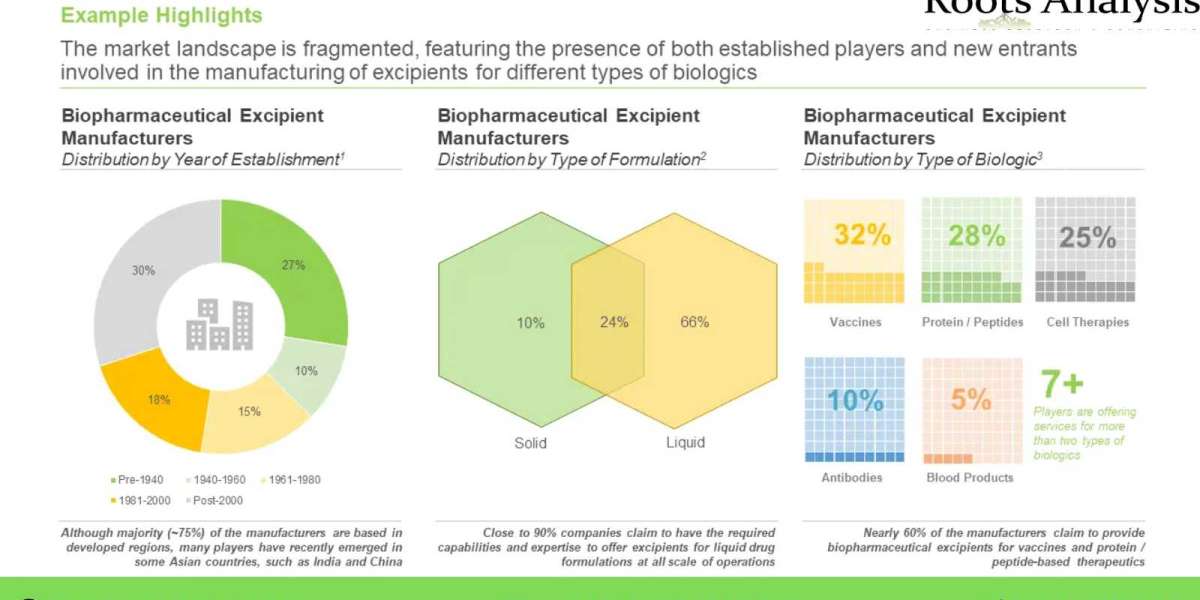

Over 40 companies, across the world, claim to offer biopharmaceutical excipients

Majority of the firms (34%) engaged in this domain are mid-sized players, followed by large firms (32%) and very large companies (19%). Close to 30% of the stakeholders were established post 2000. Further, 37% players are based in North America; within this region, the US emerged as a most prominent hub.

Partnership activity within this domain has grown at a CAGR of 70%, between 2016 and 2021

Over 40 agreements have been inked in the last 5 years in this domain; 32% of which were distribution agreements. Other popular types of partnership models adopted by players engaged in this domain include acquisitions (23%) and supply agreements (13%).

~ 40% rise in expansion initiatives in this field, during the period 2016-2021

More than 45% of such initiatives were focused on capacity expansion of manufacturing facilities, followed by those undertaken for expanding existing facilities (43%). It is worth mentioning that most of expansion initiatives (78%) were carried out in Europe and North America.

Approximately 95% of the total installed capacity is dedicated to commercial scale manufacturing

The remaining 5% of the installed capacity is focused on preclinical / clinical scale manufacturing of biopharmaceutical excipients. In addition, over 50% of the total current global, installed biopharmaceutical excipient manufacturing capacity is installed in Europe.

North America and Europe are anticipated to capture over 70% of the market share, by 2035

In addition, the market in Asia Pacific is likely to grow at a relatively faster pace (6.4%) in the long term. Further, in 2035, biopharmaceutical excipient manufacturing market for antibodies is expected to capture the majority share (~52%) of the total market.

To request a sample copy / brochure of this report, please visit

Key Questions Answered

- Who are the key players engaged in biopharmaceutical excipient manufacturing?

- Which global regions are considered as key hubs for biopharmaceutical excipient manufacturing?

- What type of partnership models are commonly adopted by stakeholders in this industry?

- What kind of expansion initiatives have been undertaken by biopharmaceutical excipient manufacturers?

- What is current, global biopharmaceutical excipient manufacturing capacity of contract manufacturers?

- How is the current and future market opportunity likely to be distributed across key market segments?

The financial opportunity within the protein design and engineering services market has been analyzed across the following segments:

- Type of Biologic

- Antibodies

- Vaccines

- Cell and Gene Therapies

- Other Biologics

- Type of Excipient

- Carbohydrates

- Polymers

- Solubilizers / Surfactants

- Polyols

- Proteins / Amino Acids

- Others

- Company Size

- Small

- Mid-Sized

- Large / Very Large

- Scale of Operation

- Preclinical

- Clinical

- Commercial

- Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- MENA

- Rest of the World

The report also features inputs from eminent industry stakeholders, according to whom, growing demand for biopharmaceutical excipients will drive the growth of manufacturers engaged in the biopharmaceutical excipient manufacturing domain, in the coming future.

The research includes profiles of key players (listed below); each profile features a brief overview of the company, financial information (if available), details related to its biopharmaceutical excipients portfolio, manufacturing facilities, recent developments, and an informed future outlook.

- ABITEC

- Avantor

- BASF

- Corden Pharma

- DFE Pharma

- Evonik

- Kirsch Pharma

- Merck KGaA

- Pfanstiehl

- Roquette

- Spectrum Chemical Manufacturing

- SPI Pharma

For additional details, please visit

https://www.rootsanalysis.com/reports/biopharmaceutical-excipient-manufacturing-market.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Gene Editing beyond CRISPR Market: Industry Trends and Global Forecasts, 2022-2035

- Cell and Gene Therapy Bioassay Services Market: Industry Trends and Global Forecasts, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact Information

Roots Analysis Private Limited

Ben Johnson

+1 (415) 800 3415